The biggest change to the island’s economy isn’t the thaw in U.S.-Cuba relations

Photographs by Sebastián Liste for Bloomberg Businessweek

The currency crisis starts about 75 feet into Cuba. I land in the late afternoon and, after clearing customs, step into the busy arrivals hall of Havana’s airport looking for help. I ask a woman in a gray, military-like uniform where I can change money. “Follow me,” she says.

But she doesn’t turn left, toward the airport’s exchange kiosk. Called cadecas, these government-run currency shops are the only legal way, along with banks, to swap your foreign money for Cuba’s tourist tender, the CUC. Instead, my guide turns right and only comes clean when we reach a quiet area at the top of an escalator. “The official rate is 87 for a hundred,” she whispers, meaning CUCs to dollars. “I’m giving you 90. So it’s a good deal for you.”

I want to convert $500, and she doesn’t blink an eye. “Go in the men’s room and count your money out,” she instructs. “I’ll do the same in the ladies room.”

The bathroom is crowded, with not one but two staff and the usual traffic of an airport in the evening. There’s no toilet paper. In an unlit stall I try counting to 25 while laying $20 bills on my knees. There’s an urgent knock, and under the door I see high heels. “I’m still counting,” I say.

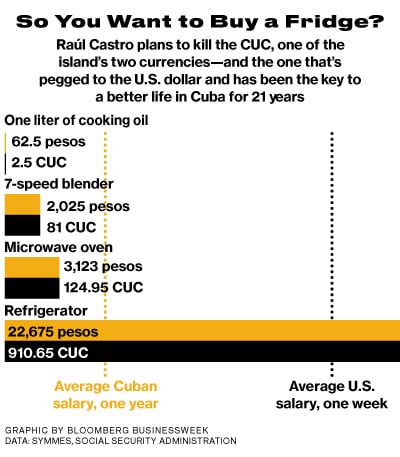

She’s back two minutes later and pushes her way into my stall. We trade stacks, count, and the tryst is over. For my $500, I get 450 CUCs, the currency that’s been required for the purchase of almost anything important in Cuba since 1994. CUCs aren’t paid to Cubans; islanders receive their wages in a different currency, the grubby national peso that features Che Guevara’s face, among others, but is worth just 1/25th as much as a CUC. Issued in shades of citrus and berry, the CUC—dollarized, tourist-friendly money—has for 21 years been the key to a better life in Cuba, as well as a stinging reminder of the difference between the haves and the have-nots. But that’s about to change: Cuba is going to kill the CUC. Described as a matter of fairness by President Raúl Castro, the end of the two-currency system is also the key to overhauling the uniquely incompetent and centrally planned chaos machine that is the Cuban economy.

Even in Cuba there are markets, and the effects of Castro’s October announcement of a five-step plan for phasing out the CUC are already rippling out to every wallet in the country. The government has issued notifications and price conversion charts, and introduced new, larger bills to supplement the low-value national peso. Over the next year, the CUC will be invalidated—what Cuban economists call Day Zero—and then, in steps four and five, the regular Cuban peso will become exchangeable and be floated against a basket of five currencies: the yuan, the euro, the U.S. dollar, and two others to be named later.

Thanks to the expected normalization of relations with the U.S., tourism, already the engine of Cuba’s current economic boom, is expected to grow enormously—though by this time next year foreigners will be required to negotiate their visits with mounds of regular pesos. Raúl Castro is effectively gambling that he can release some control over the economy in exchange for growth, ensuring the regime’s survival.

The reality, however, may be anything but orderly. During my visit, I witness the hoarding of dollars, an unstable black market, and a deep distrust of the government’s financial speculations. Get out of CUCs, the rumors urge, and into dollars. For a 3 percent spread, a woman will even follow you into a bathroom stall.

Those in the peso-only economy are completely dependent on the government

In January 1961, a cargo ship arrived in the harbor of Santiago de Cuba bearing a load of freshly minted cash. Cuba’s pre-revolutionary peso had been stable and valuable for decades, a source of patriotic pride. Overnight, the Cuban revolution invalidated the old peso and replaced it with new bills, signed by Che Guevara and worth what the government said they were worth. The gesture sidelined opponents, reduced the independence of the professional and middle classes, and effectively seized the island’s remaining wealth in one gesture. In 1967, when Che died, it was his face that went on the currency, memorably gracing a 3-peso note that would get you lunch and a drink. Today that same bill is worth 12¢.

The end of Soviet subsidies in 1991 brought real economic desperation to Cuba. Dollars were traded on the black market. (In a dark Havana alley, I once got 125 pesos for a single greenback in a hurried transaction with a frightened man.) By 1994, in an effort to co-opt the black markets and once again take hold of the island’s resources, the government introduced the CUC. Initially this was strictly for tourists, the only legal tender for all those mojitos and langoustines. The CUC was pegged at 1:1 with the U.S. dollar, and just the commissions on exchanging it—up to 20 percent—earned the Cuban government billions a year.

The CUC turned tourism into a lucrative lifeline during the 1990s, and at first only a few essential imports—shoes, soap, tires—were sold to Cubans in CUCs, at a few, heavily guarded stores. Today those misnamed “dollar stores” exist in every neighborhood, and the CUC, first intended to insulate Cubans from capitalism, is the only way to buy the majority of consumer goods.

This is the Cuban dilemma: Salaries are paid in ordinary pesos, and average just $20 a month, even though the cost of survival runs around $50 a month, and must be paid for with CUCs at government stores that, until now, accepted nothing else. As crazily inefficient as the existing two-currency system appears, it has allowed the government to maintain near-total dominance of the economy. The Cuban revolution has always viewed money as a problem, not a solution. That’s why the peso of the old republic had to be destroyed overnight in 1961. Having money let people be independent and operate outside the system. “It’s part of the DNA that Fidel imprinted on the revolution,” notes Ted Henken, a sociologist at Baruch College who has specialized in the island.

What the government has finally grasped is that the two-currency system has become economically and politically unsustainable. To get around it, Cubans steal state resources, work black market jobs, and even arbitrage the price differential between mangoes at opposite ends of the country. “Those in the peso-only economy are completely dependent on the government, which is in control of more than 85 percent of the total economy,” says John Kavulich, president of the U.S.-Cuba Trade and Economic Council in New York. For the citizenry to “have a legitimate stake in the economy,” he notes, there should be one currency, used for salaries and all stores, and traded openly. “It needs to happen,” Kavulich says.

There are over 250,000 entrepreneurs in Cuba since the new opportunities. This is a door opening that isn’t going to close.

No política. That’s what Yamil Alvarez Torres says as he settles onto a hotel sofa in Old Havana, his Under Armour socks showing a fashionable amount of ankle from beneath pressed jeans and a striped dress shirt. Alvarez looks the part of the new Cuban entrepreneur, a successful restaurant owner who has bourgeois hobbies—dogs and free diving—and an almost unlimited confidence in the future. But no politics. Like most Cubans, he avoids talking or even thinking about the nation’s closed and secretive political system too much.

Havana today is in physical bloom. A gallon of paint costs 30 percent of a typical monthly salary, yet half the houses in the city seem freshly painted. The once-ubiquitous and fuming thunder chariots of old Detroit are either shined up with new chrome and paint or, more often, sidelined by more recent and reliable Korean and Chinese vehicles. The people I’d known on the edge of starvation over the last 20 years of visiting are now fighting the creep of their waistlines and the return of pastries and deep-fried everything at street-corner kiosks. Even in 1991, Cuba seemed more open than it was, an island without barbed wire or machine guns, the friendly blue ocean serving as its Berlin Wall. Now the openness is tangible: In December, Cuba and the U.S. announced that the two intend to reestablish relations after more than four decades of enmity. On Havana’s streets, there’s a charge of anticipation, and one senses a people eager to embrace the world.

A “bookshop” located at the door of a private residence in Havana. Until a few years ago, Cubans were not allowed to open private businesses.

“It’s getting easier and easier to do business in Havana,” Alvarez tells me. “If you get your logistics worked out, you can do it.” I’d first visited his restaurant, Los Mercaderes, two years before, when he’d opened it as a paladar, or home restaurant, and the place had an empty, tentative feel. Now he has 50 employees and full tables every night, with musicians treading out jazz and Buena Vista Social Club hits from a tiny balcony; he and his wife have moved to another property.

He’s nonplussed about the currency change: “If you are running a business and doing well, you are going to do well with one currency or two. … Honestly, I believe that anything you do efficiently and professionally is going to succeed in Cuba.”

Efficiency and professionalism require reversing decades of perverse Cuban incentives, however. Most waiters are state-trained and paid in worthless pesos: They often spend more time on break, or talking to friends in the street, than attending to diners. “They expect to have their job forever,” Alvarez says. “They get used to being bad.” So he hires blank slates: English-speaking college grads, many of whom have never seen the inside of a nice restaurant before. “The main thing,” Alvarez says, “is we want zero experience.”

He sounds optimistic. “Very,” he says. “There are over 250,000 entrepreneurs in Cuba since the new opportunities. … This is a door opening that isn’t going to close.”

If the opening has an official advocate, it’s Omar Everleny, the lead economist at the Center for the Study of the Cuban Economy. The center is in a onetime private residence in an elegant Havana neighborhood, surrounded by embassies. Despite arriving at the building with an appointment at 4 p.m., I find it empty; the next morning Everleny meets me in the library, amid the smell of decaying paper, to walk through the slow death of the CUC and the likely benefits for Cuba.

Everleny, like many Cubans, can recite the exact date economic reforms began: Sept. 9, 2010. Raúl Castro had assumed control in 2006, during his brother’s gastrointestinal illness. But his official promotion to leadership took two more years, and not till the fall of 2010 did he spell out reforms that expanded self-employment, removed limits on hiring by small businesses, and protected foreign investors from expropriation. Joint-venture hotels are routine now, with 60,000 rooms available. A new container port at Mariel, built by the Brazilian government, has created export capacity for a country that exports very little. More important, Brazilian President Dilma Rousseff has gambled that pharmaceutical production and other tightly controlled businesses can thrive here.

The most probable scenario is that Cuba will reluctantly follow the China model. Cuba isn’t embracing freewheeling capitalism—Cubans are still allowed only one business each and are hemmed in on all sides by monopoly controls—but the back streets of Havana reminded me of no place more than the grim but awakening Beijing of 1987, when the People’s Republic also had two currencies. Cuba limits self-employment to 201 categories, like Doll and Toy Repair (No. 128) and Breeder/Seller of Pets (No. 26). Even so, the number of licensed entrepreneurs has grown from 140,000 in 2010 to more than half a million today. Unlike a previous wave of self-employment in the 1990s, which was limited to survival-oriented trades like knife-sharpening (No. 6) or tire repair (No. 113), about half of today’s licensed businesspeople are real entrepreneurs, concentrated heavily in tourism and restaurants but including taxi drivers, transport companies, clothing shops, cooperatives producing baby clothes, and lots of construction.

Raúl Castro has meanwhile removed a series of prohibitions that infuriated Cubans: They can now own cell phones, buy and sell their houses, and even stay in the hard-currency hotels (817,000 did last year) that were once the symbol of foreign privilege. Raúl has also loosened, if not released, his grip on expression. Dissidents and regime opponents who were long blocked from leaving the country are now routinely seen at conferences in Miami, New York, and Brussels. In the 1970s, Cuba had some 15,000 political prisoners; today that number is between 50 and 60, according to the Cuban Commission for Human Rights and National Reconciliation.

The currency change is already happening, Everleny notes. Step one was to tell people, to prepare them psychologically for the coming transition. Step two, which began a week before my February arrival, was to roll out new, larger-denomination peso bills, so that people could pay higher prices without carrying a backpack.

The timing of the remaining three steps remains vague, in the Cuban way. Raúl had said in his speech that the two currencies had to be reconciled before the next Communist Party congress. That’s scheduled for April 16, 2016. The only thing known was that Day Zero would come before then.

To see how Raúl’s changes and the looming currency conversion are playing out, I travel to Sancti Spíritus, a colonial town in central Cuba I hadn’t seen for 24 years. I’d hitchhiked there in 1991, a two-day epic that required waiting under bridges with crowds of kind but needy Cubans and a return trip on a dilapidated train that stopped randomly for hours. This time I buy a seat in an unmarked Moscovich, a legal private taxi that roars inland, stopping only to slip behind a barn to buy black-market gasoline, fuel that was manually cranked into our tank. “Sorry about the smell,” my driver says, “but this is the only way.”

Six hours of driving sweep me into the flat, colonnaded city. Many things are still as I remember them. The streets are sleepy, the bars bleak, and the local bus network consists of eight-person carts towed by horse. Yet even here there’s fresh paint, a computer repair business, and private furniture shops. I try to pay for ice cream with CUCs, making the woman laugh; the price is in pesos, 1/25th as much. The reverse happens at night, in the town’s best restaurant. Because everyone in the place is Cuban, I expect grim portions and pesos. But the shrimp are superb, a sommelier shows off a genuine wine cellar, and the Cubans all pay hard-currency prices, half a month’s salary on beer, beef, and watching baseball. In two decades of visiting, this is the first time I’ve shared a real restaurant with Cubans.

In the morning I go to buy a refrigerator. Home appliances are one of the most desirable items in Cuba, but their sale is restricted to a narrow range of state stores called electrohogars, and Sancti Spíritus has two of them off the town plaza. One is shut, the other sleepy and small, with more floor space given over to selling ice cream and soda than consumer durables. But in one corner are hair curlers, electric frying pans, all-in-one laundry machines, and a few Daewoo refrigerators. Many Cubans are eager to replace their 1950s fridges, but buying a full-size model means coming up with 910.65 CUC. At the bathroom-stall conversion rate, that’s $1,001, or twice the price of a similar model on Amazon.com. It’s also—as a new price tag says—22,675 pesos, or about four years’ worth of the average Cuban salary. “If you’re going to buy a refrigerator,” Everleny tells me, “you’re not going to pay for it with 20s. You’d have to carry a trunk.” The release of new, larger denominations of standard peso bills is meant to smooth such transactions, but a year from now, with the peso possibly floating against a basket of currencies, there’s a risk that hidden inflation and exaggerated purchasing power could surface. Many people are hoarding hundred-dollar bills simply to be safe.

On the way back to Havana, I ride on a CUC bus. In the past, regular people had no choice but to ride peso buses that were scarce, slow, and crowded. For 23 CUCs I get a seat on a punctual express that fills up mainly with foreign tourists but also some Cubans, the kind who have more than an average month’s salary to spend on a bus ticket. We pass quickly through a string of grim cities—Colón, Cárdenas, Matanzas—all poor and unvarnished yet bustling with shops and commerce I’ve never seen before in Cuba. Like a vacuum, the unmet demand of Cubans is pulling reform to the farthest corners of the island.

Cuba has had a mixed economy for a long time: socialist until the food ran out, free-market thereafter. Critically, some of those markets are now legal and enriching, like the new real estate market that has seen houses in prime parts of Havana trade for hundreds of thousands of dollars (or CUCs, actually). There are also smaller, more clandestine markets, even for things like data. Many thousands of Cubans pay a fee to get what’s called el paquete, an assortment of films, TV shows, video games, glossy magazines, and books from inside and outside the country. Cuba is ranked alongside Iran and North Korea for Internet censorship, with only a heavily filtered intranet available at an hourly price. El paquete is therefore a black-market delivery system, full of inefficiencies. The information is hand-carried into the country once a month, and the collection of American, Spanish, Mexican, and even Cuban media is passed around Havana on a terabyte-sized drive, or shared via illegal Wi-Fi networks in private homes.

The blogger Yoani Sanchez points out that this black market in information sticks to a familiar Cuban rule—nothing in el paquete should be explicitly political, to avoid drawing attention. But even the apolitical is subversive here, she says; when Cuban readers flock to lifestyle articles and glossy celebrity magazine covers, they’re imagining themselves in a different country. Everything they see in this digital realm—churros recipes, listicles on the secrets of entrepreneurial thinking—is part of a different state of mind, a terabyte of autonomy and desire.

Even though the economy looks better than at any time since 1991, Cuba remains deeply, dangerously reliant on Venezuela’s collapsing economy. The heirs of Hugo Chávez have kept the lights on in Havana by granting Cuba 100,000 barrels of oil a day at about half the market price. That effectively hides 45 percent of the island’s trade deficit. Venezuela also pays $5.5 billion a year for the almost 40,000 Cuban medical professionals who now make up half of its health-care personnel. Neither support can endure unchanged.

When MasterCard announced it would begin accepting charges from Cuba on March 1, the Cuban government slapped that down. U.S. airlines can now start flying directly to Cuba, or so Washington says—but there will likely be years of negotiations over safety, landing fees, and the reciprocal right of Cubana, a state-controlled, military-operated airline, to land its planes in Miami. The last thing on the Cuban list of reforms is sharing power. The Communist Party reflexively insists that nothing will change in Cuba, ever, but Obama’s rapprochement is certain to have an effect. Dissidents, the politically ambitious, and human-rights activists believe that some day they’ll be legally allowed to exist and their now-secretive work can become routine. The death of the CUC may turn out to be Day Zero for more than funny money.